From Gut Feel to Customer Logic: Using Decision Trees to Fix Fashion Assortments

Most fashion and footwear retailers face similar pain points:

- High markdowns at the end of season despite “good” sell-through in some SKUs

- Wrong stock in the wrong stores, with excess in some locations and sell-outs in others

- Broken size curves and missing core sizes in key styles

- Weak replenishment logic, driven by past sales rather than true demand

- Siloed data: merchandising, e-commerce, and stores each seeing a different picture

Underneath these issues is a simple fact:

The business is organised around internal categories and buying structures, while customers shop based on missions and decision rules in their heads.

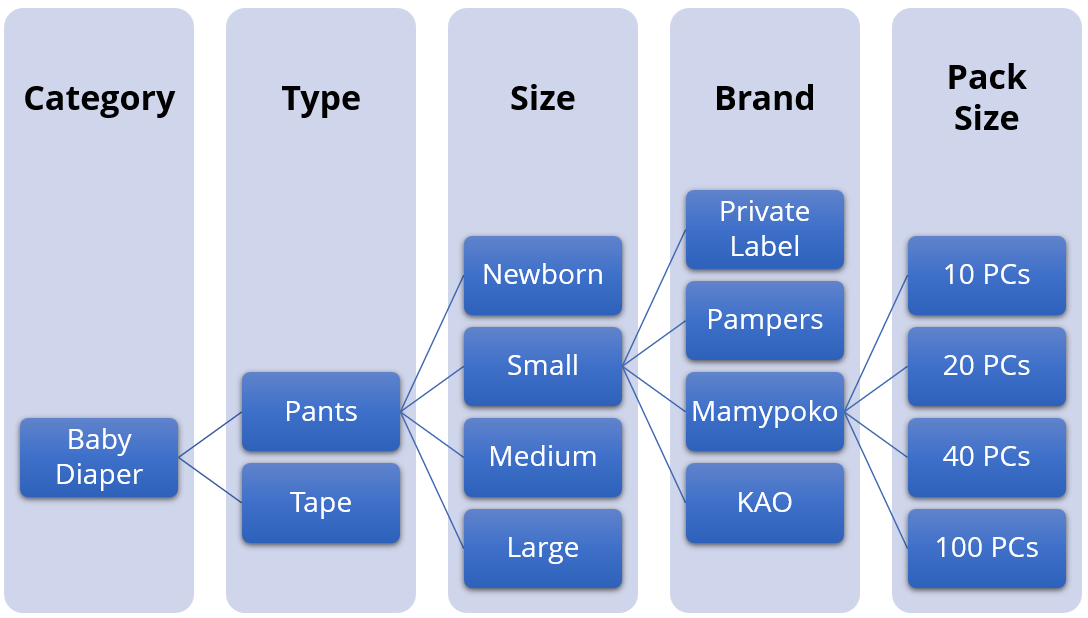

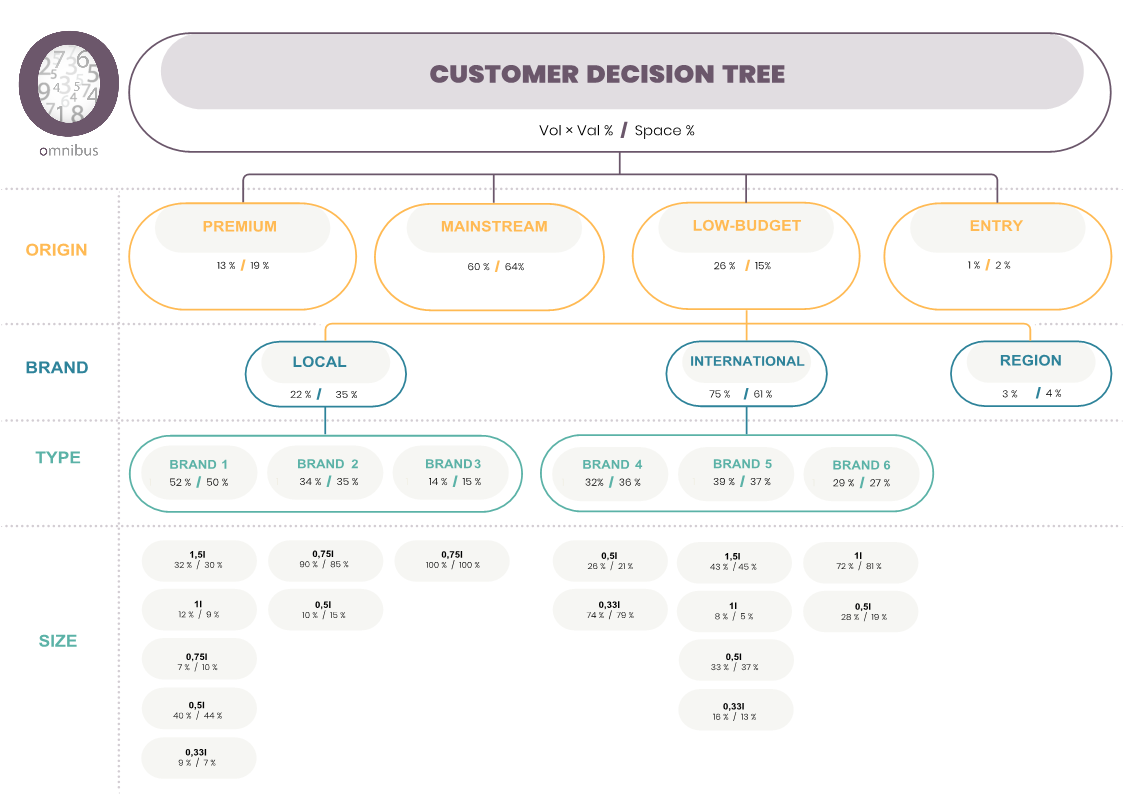

A Customer Decision Tree (CDT) is a practical way to make those decision rules visible and usable. RELEX defines a CDT as a “visual roadmap of the steps and criteria a customer considers when purchasing,” revealing the hierarchy of attributes that matter (brand, size, price, quality, etc.).

CDTs have been used for years in FMCG and grocery to improve assortment, shelf layout, and profitability.

Bain & Company and others show that CDT-led category management can deliver measurable uplifts in like-for-like sales and profit. In fashion, where assortments are more complex (sizes, fits, colours, trends, omnichannel journeys), the impact is even greater — and much harder to manage without a structured approach.

This post explains what CDT means for fashion retail, how it links to stock standards and hidden lost sales, and how to implement it as part of your broader data and AI transformation.

1. What is a Customer Decision Tree (CDT) in fashion retail?

In plain language:

A Customer Decision Tree is a map of how your customer chooses within a store/category — which questions they answer first, second, and third when deciding what to buy.

It is not your internal category hierarchy. It’s the sequence of choices in the customer’s mind.

Example 1: Women’s sandals

Imagine a shopper entering your store or category page with a mission: “I need sandals.” A simple CDT could look like this:

Root: “Women’s sandals”

1st split: Occasion → Work / Casual everyday / Wedding & party

2nd split (Casual): Heel height → Flat / Mid / Wedge

3rd split: Style → Strappy / Slides / Sporty

4th split: Colour → Black / Neutrals / Fashion colours

5th split: Size & width

- On the website, these nodes become filters and sort orders.

- In-store, they define how you group the wall (by occasion / heel height / colour blocks) and which “core” SKUs must always be in stock.

Example 2: Kidswear

For kidswear tops, a CDT may start with:

Age band (0–2 / 3–5 / 6–10 / 11–14)

Then use (school / play / party)

Then sleeve length (full / half / sleeveless)

Then fabric (cotton-rich / synthetic)

Then theme (plain / character / graphic)

Parents on your app may first filter by age and school vs casual; teenagers on Instagram might start from brand or aesthetic.

CDTs for different segments and missions

The structure of the tree changes by segment and mission:

- A value-conscious shopper may start with price band, then size and fit, and only then colour.

- A wedding guest searching for ethnic wear may first pick occasion, then silhouette (lehenga / maxi / saree-style), then embroidery level and colour, with price as a “deal-breaker” filter at the end.

- A sneakerhead might start with brand, then collection, then size and colour.

Oracle’s assortment planning guidance shows this logic explicitly in dress categories: a decision tree that starts with dress type (formal vs casual), then sub-types (cocktail vs sundress), and only then colours, sizes, and brands.

CDT is all about capturing these real decision paths and making them the backbone of assortment, layout, and digital experience.

2. Case studies of CDT Application

Below are examples that show CDT-style thinking in practice.

- Omnibus, a retail design consultancy, describes work with a 1,500 m² Slovenian supermarket where CDT-based space and assortment decisions were central. After redesigning layout and assortment:

- Inventory was reduced by 8%

- Store profitability increased by 5%

- Space profitability improved by 20%

- Later, a full layout overhaul (where CDT was “crucial”) supported 25% annual sales growth

Although this is grocery, the mechanism is directly transferable: identify key CDT branches; protect space and stock for those branches; cut duplication where customers do not differentiate.

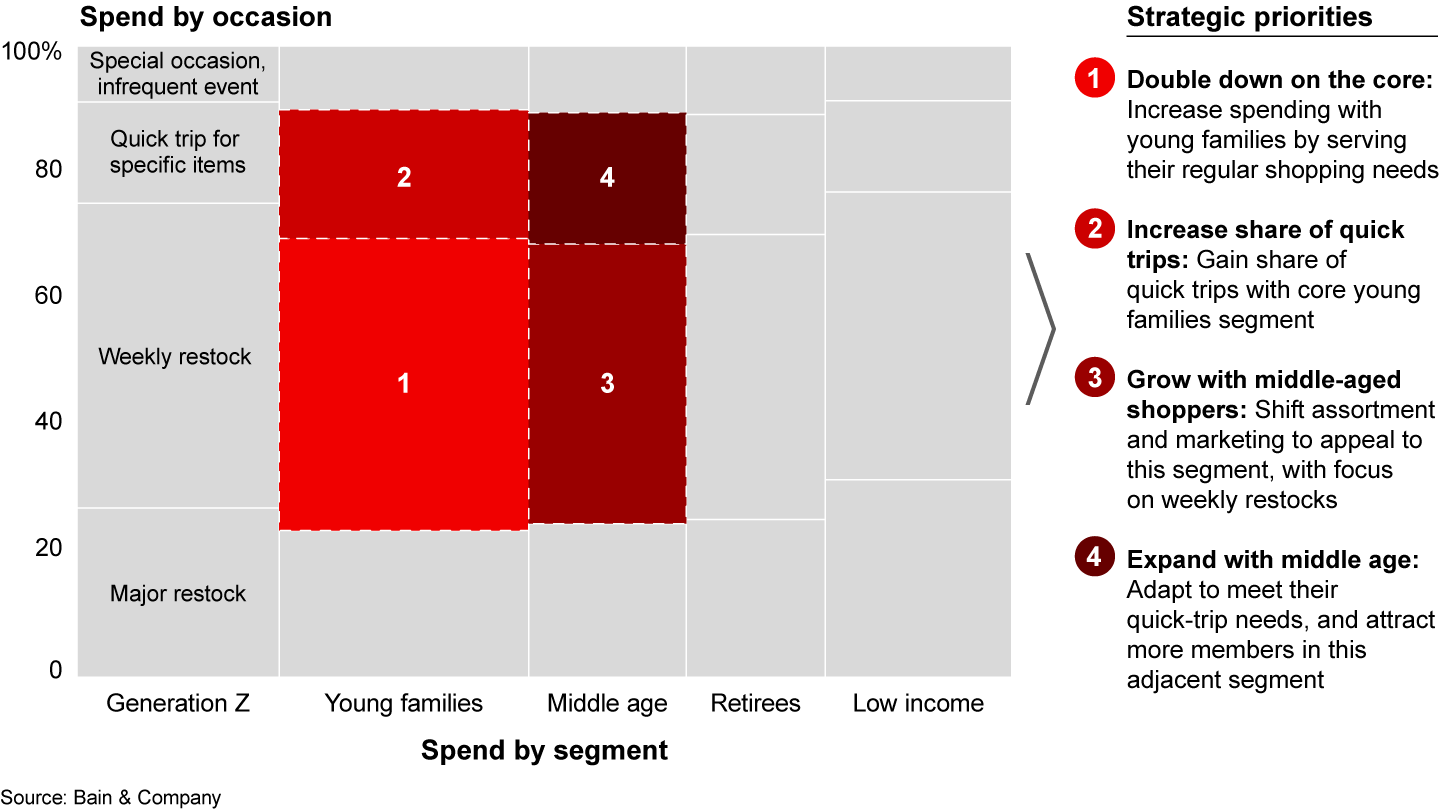

- Bain & Company reports a grocer that used a detailed customer decision tree to redesign a fresh-produce category and adjust pricing, promotions, and assortment. The result was about 3% like-for-like sales growth in that category after years of decline.

These examples show that when retailers align assortment and space with the way customers actually decide, they get less inventory, higher profit, and higher sales — in measurable percentages, not theory.

- Mr Price (South Africa) reallocating assortments mid-season after pandemic shifts: smaller neighbourhood stores received more stock while big mall stores received less. This shift revived sales, reduced unsold inventory, and protected the bottom line.

- Forever 21 using detailed data on colour, size, fabric, and neckline to decide what to carry where, effectively working along a decision tree of style and attribute combinations to match local demand.

McKinsey research show that retailers who leverage advanced analytics outperform their peers by 68% in earnings before interest and taxes (EBIT) and continue widening the gap. While this is about analytics generally, not CDT specifically, CDT is one of the foundational models that analytics platforms use to structure demand, assortment, and size/colour decisions.

3. Why CDT is critical for fashion retailers

CDT is not a “nice to have”. It connects directly to almost every core merchandising and retail process.

Assortment planning and range architecture

- Use CDT nodes (occasion, style, heel height, fabric, price band) as the spine of your range architecture.

- Ensure every “must-have” node (e.g., black flat sandals for everyday wear) has at least one strong option and sufficient depth.

- Use CDTs with profitability metrics (as RELEX does with Direct Product Profitability) to identify core vs optional SKUs per node.

Store clustering and planograms

- Cluster stores based on which CDT branches dominate (e.g., value casual vs bridal-heavy vs office-heavy clusters).

- Design wall plans and tables by decision flow, not by vendor line-up. DotActiv recommends using consumer decision trees when creating customer paths and grouping (e.g., corporate wear section, then by brand, and by colour and size logic).

Replenishment and allocation

- Instead of generic min/max rules at SKU level, set rules per CDT node, then distribute volume across SKUs within that node.

- Protect replenishment for core nodes (e.g., top 3 decision paths in each category) before spending open-to-buy on peripheral branches.

E-commerce navigation, filters, and search

- Turn CDT levels into intuitive filters and default sort sequences. Oracle highlights that customers “work their way through product hierarchies” (e.g., dresses → formal vs casual → cocktail vs sundress).

- Ensure site search synonyms and filter combinations reflect real missions (e.g., “teacher shoes”, “eid dress”, “office kurta”) mapped to decision nodes.

Personalization and recommendations

- Use CDT nodes as features in recommendation models: “customers who bought from this branch of the tree also buy from that branch”.

- Move from “people who bought this SKU also bought…” (purely item-based) to “people in this mission/decision branch tend to consider these other nodes.”

Linking CDT to stock standards and hidden lost sales

Here, CDT becomes a diagnostic tool:

- Gaps in stock standards

- If your CDT shows that 40% of customers in women’s sandals start with “everyday, flat, black”, but your range has 20 experimental colours and only one black flat that constantly sells out, your stock standard is misaligned.

- In the Omnibus supermarket case, aligning assortment and space with CDT allowed the retailer to cut inventory by 8% while increasing profit by 5% and space productivity by 20%. The same mechanism applies when you reduce duplicate fringe styles and reinvest in core branches in fashion (this application to fashion is inferred).

- Hidden lost sales

- A CDT quantifies where lost sales hurt most: missing size 38 in the “everyday black flat sandal” node is far more damaging than missing a fringe colour in a niche node.

By making these gaps visible, CDT provides a tangible way to link customer-centric thinking with hard numbers: sales, margin, markdowns, GMROI.

4. CDT, data foundations, and analytics: how it all fits

CDT work only scales when it is wired into your data and analytics foundations. For fashion retailers, this typically means:

- Product master data

- Rich, clean attributes aligned to CDT nodes: occasion, style, silhouette, heel height, fabric, fit, price band, colour family, etc.

- Consistent attribute coding across ERP, PLM, POS, and e-commerce platforms.

- Unified transactions

- Store and online sales in a single model so you can see decision patterns across channels, not in silos.

- Returns and exchanges linked back to the same product attributes.

- Store/product/customer hierarchies

- Store clusters expressed in CDT terms (e.g., “value casual-heavy”, “kids-heavy”, “wedding-heavy”).

- Customer segments linked to CDT paths via loyalty data or clickstream.

Once CDT is embedded in your data model, you can:

- Forecast demand at the node level (e.g., “flat black sandals for everyday in cluster A”) and then allocate that demand across SKUs.

- Localise assortments: activate or deactivate nodes per cluster or channel and let analytics choose the best SKUs within each.

- Improve search, filters, and recommendations using the same decision attributes across web, app, and store tools.

In other words, CDT becomes a reusable data product that feeds forecasting, allocation, pricing, and personalisation, rather than a one-off PowerPoint exercise.

5. Self-assessment checklist for CEOs/COOs

Use this as a quick diagnostic across four dimensions. Answer honestly with Yes / Partially / No.

A. Customer understanding

- We have clearly defined customer missions for our top categories (e.g., workwear, wedding, everyday).

- We know the top 3–5 decision attributes (e.g., occasion, heel height, fit, colour, price) that truly drive choice in each key category.

- Store staff and e-commerce teams share a common language for these missions and attributes.

B. Data & systems

- Our product master data has clean, consistent attributes that reflect how customers choose (not just vendor codes).

- Store and online transactions are unified so we can analyse behaviour across channels.

- Our e-commerce filters and navigation reflect real decision steps, not just internal categories.

C. Process & governance

- Assortment and range planning explicitly use customer missions and decision attributes, not only last year’s sales.

- There are documented rules on core vs optional assortment by store cluster or channel, linked to decision nodes.

- CDT-like structures (missions, attributes, nodes) are governed and updated regularly.

D. Usage in decisions

- Buyers and planners can show, in one page, how their ranges cover the key decision nodes and where gaps remain.

- Store and allocation teams use node-level logic in replenishment and transfers (not just gut feeling).

- Marketing, CRM, and digital teams use the same decision attributes for campaigns and recommendations.

The more “No” or “Partially” you see, the more value you are leaving on the table.